Client Overview

Our client, a leading fintech provider, aimed to enhance financial accessibility while reducing transaction complexities and costs.

Their vision was to build a seamless digital ecosystem that improves user experience, streamlines financial operations, and ensures customer satisfaction.

1.3m

Users

0.5 m

Active Users

0.3 m

New Downloads

User Stories

Key BPMN

Tech Scope

What we did

Design

Design

Maze

Figma

Engineering

Engineering

Trymata

Adobe

userbob

Miro

Maze

Figma

The Problem

1

High Transaction Processing Costs

Manual processing and outdated systems increase operational expenses.

2

Limited Financial Inclusion

Traditional financial systems make onboarding and credit access difficult.

3

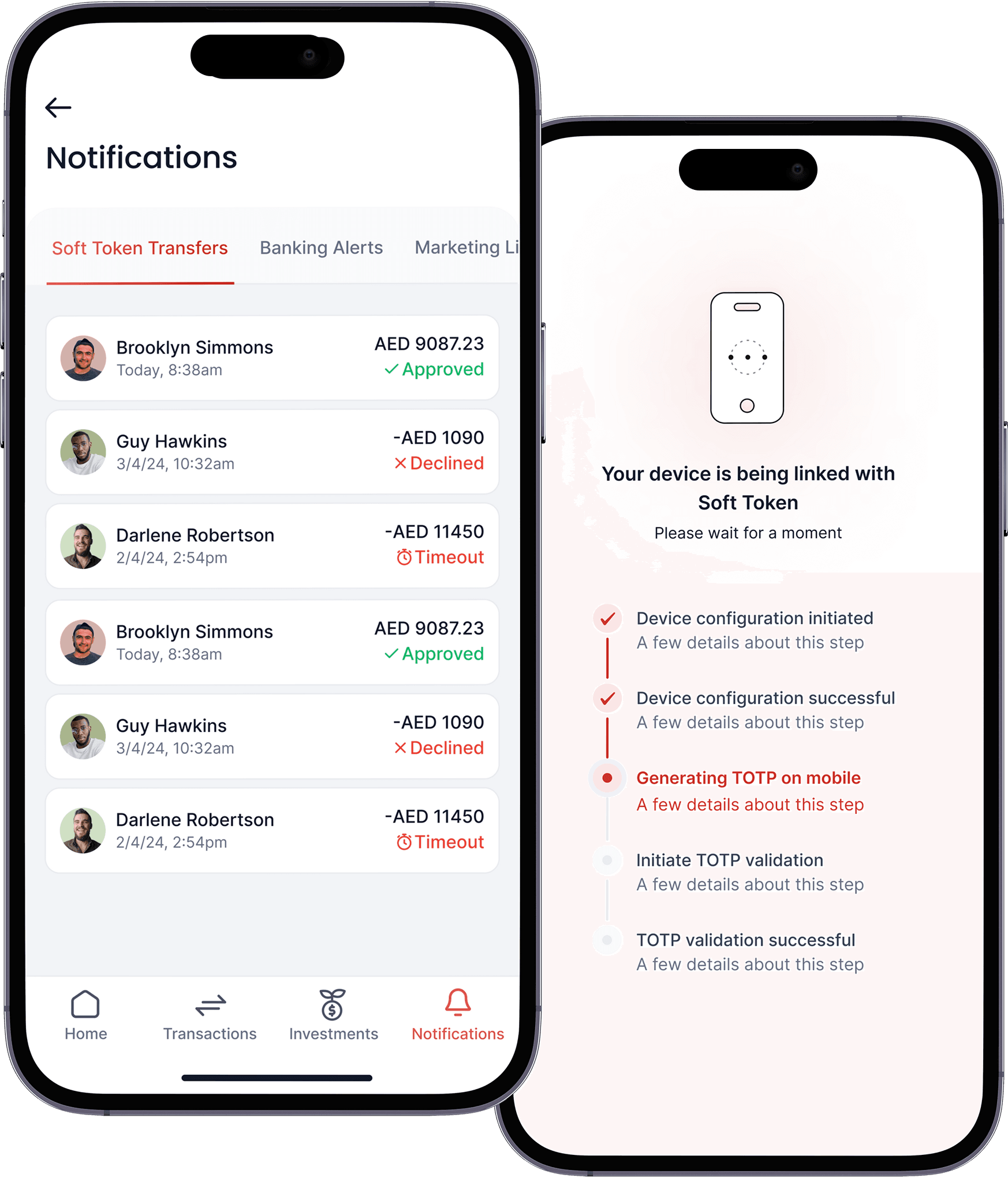

Fraud & Security Risks

Growing digital transactions increase the risk of fraud and cyber threats.

4

Lack of Personalized Financial Services

Users receive generic financial products that don’t match their needs.

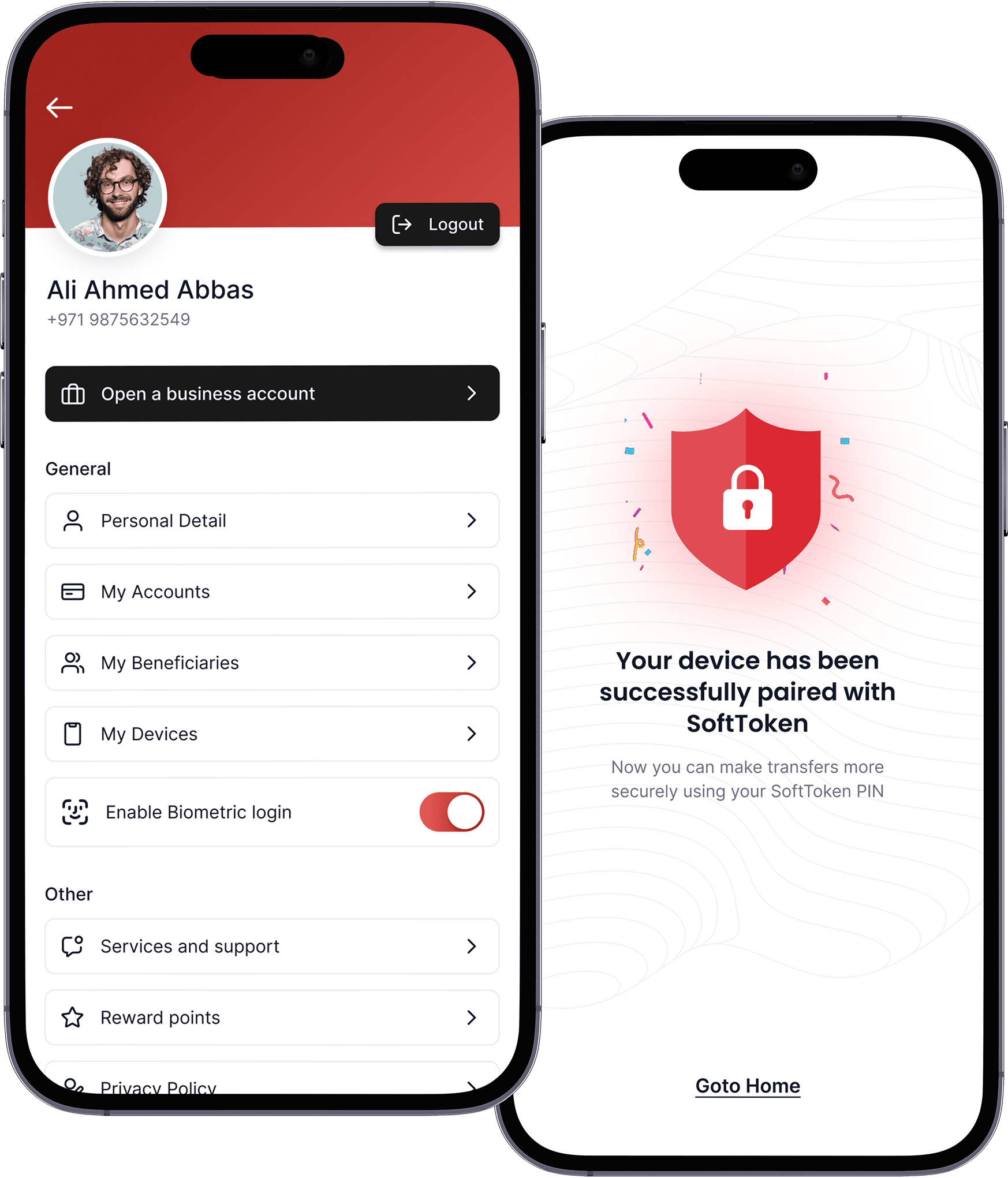

Our Solution

1

Smart Financial Management

- AI-powered insights help users track expenses, savings, and investments in real time.

- Automated budgeting and goal-based savings features improve financial planning.

2

Transparent & Low-Cost Transactions

- Zero or minimal transaction fees for payments, transfers, and international remittances.

- Real-time cost breakdowns ensure transparency and build user trust.

Our Solution

AI-Based Financial Insights

Low-Cost Transactions

Automated Budgeting

Instant Fund Transfers

Fraud Detection

Credit Score & Loan Assistance

Multi-Layer Security

Results

Reduced Fraud & Enhanced Security

30%

Stronger authentication measures and AI-driven fraud detection minimized unauthorized transactions.

Increased Customer Engagement

47%

Personalized financial insights and AI-powered budgeting tools enhanced user interaction.

Operational Cost Efficiency

3k+

Automated loan processing and digital KYC reduced operational expenses and turnaround time.

Improved Financial Inclusion

40%

Expanded access to digital banking services for underserved communities and small businesses.

Over all, Increased user satisfaction with 92% positive feedback.

Results

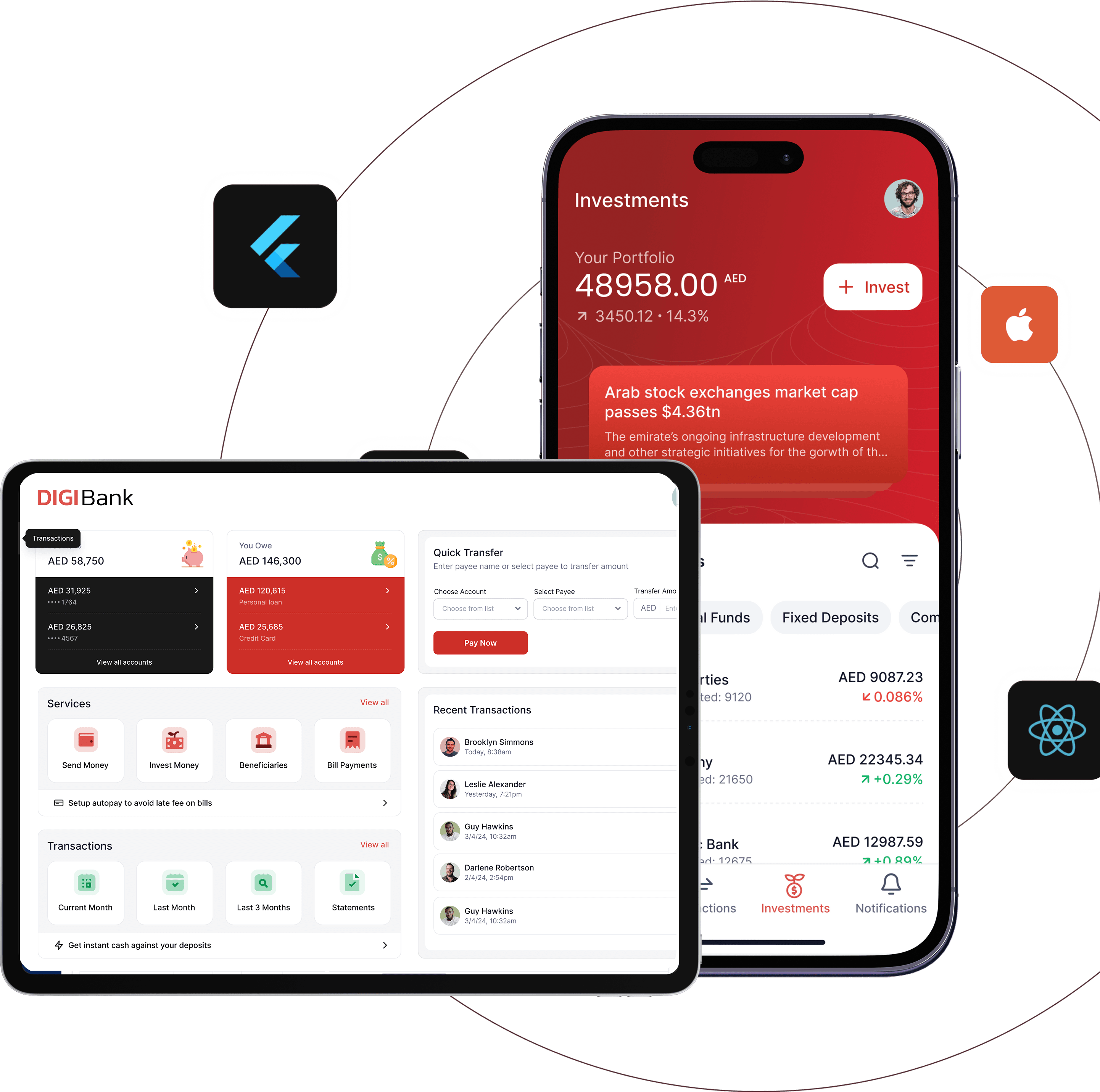

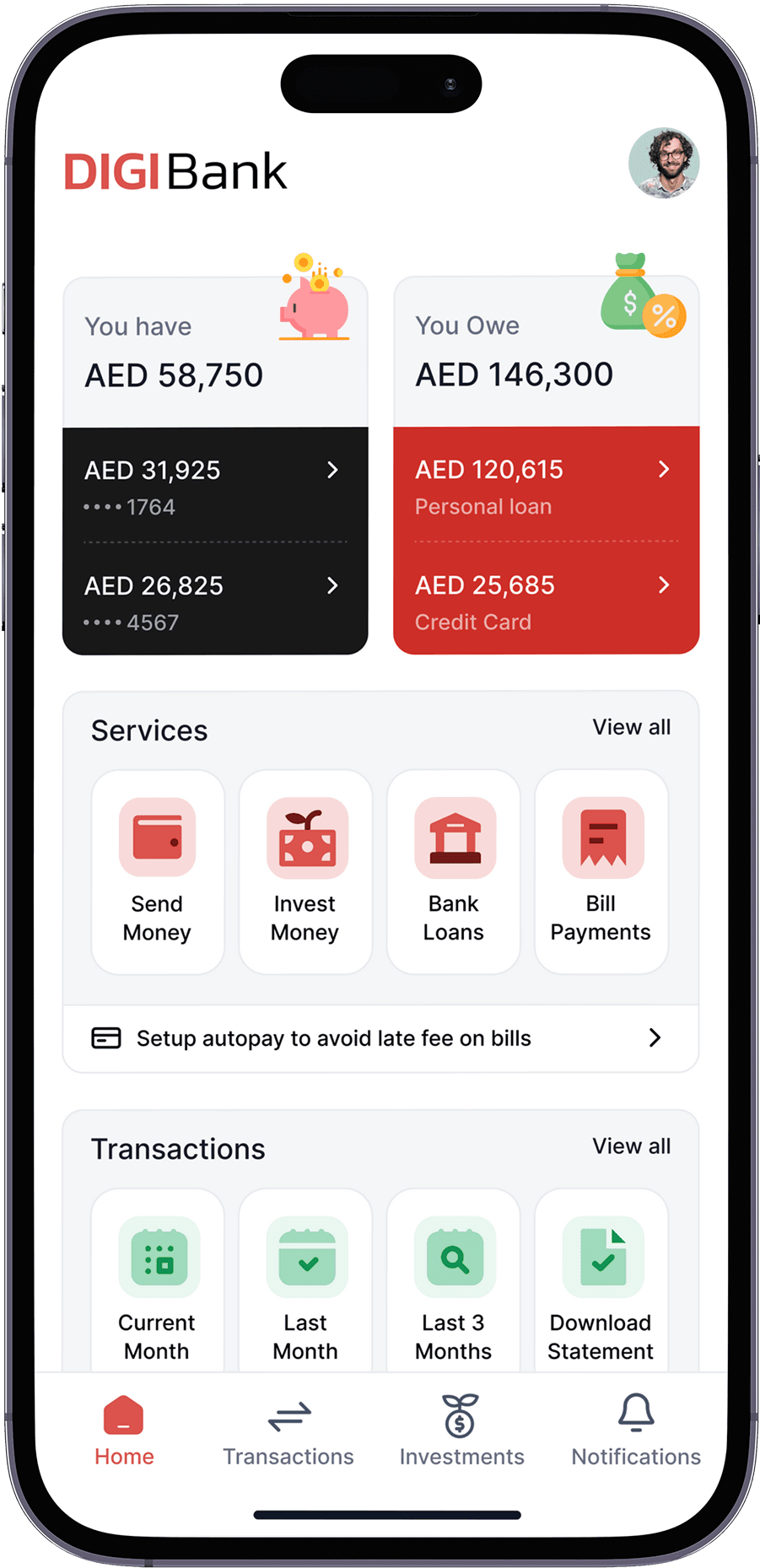

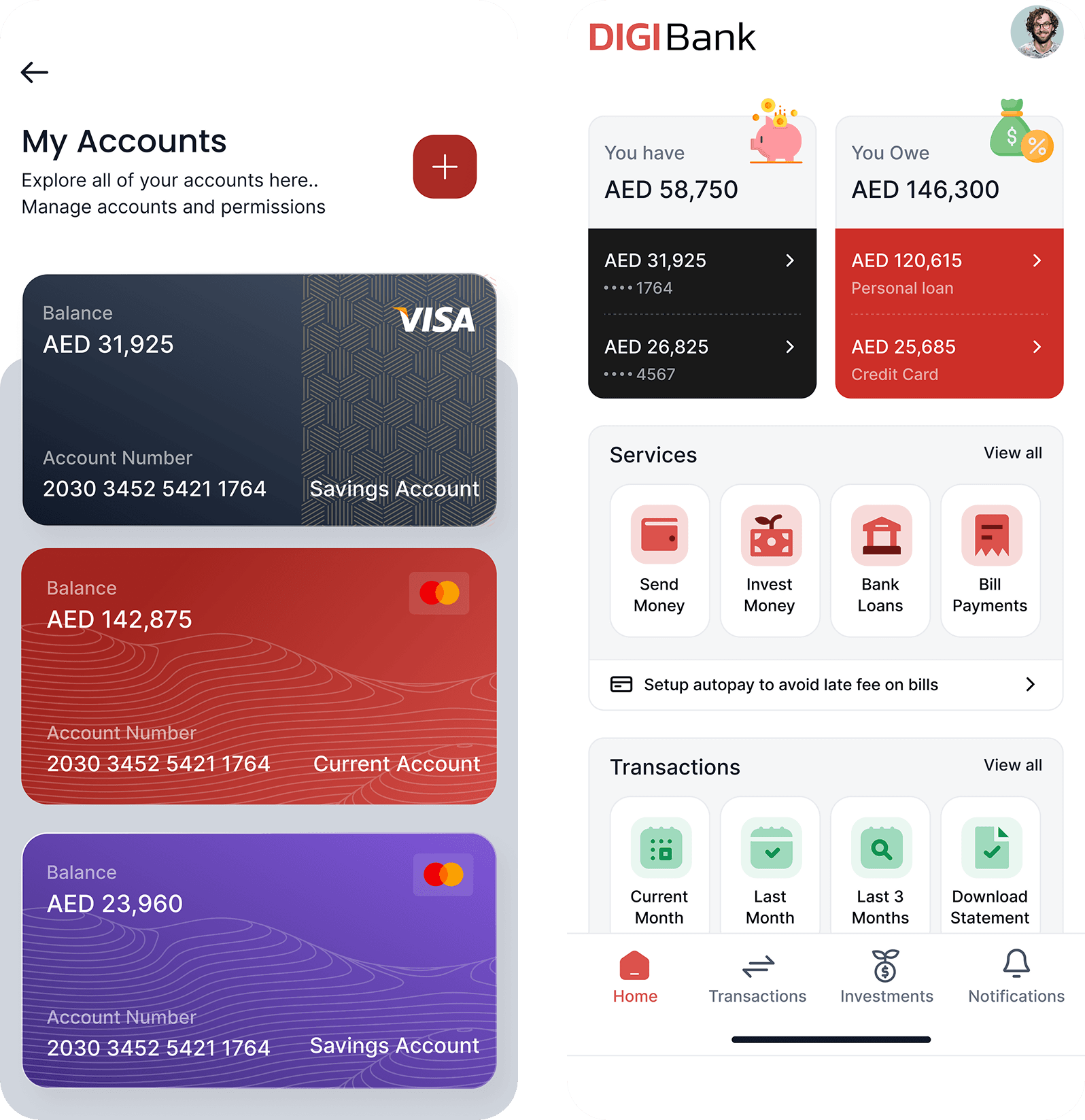

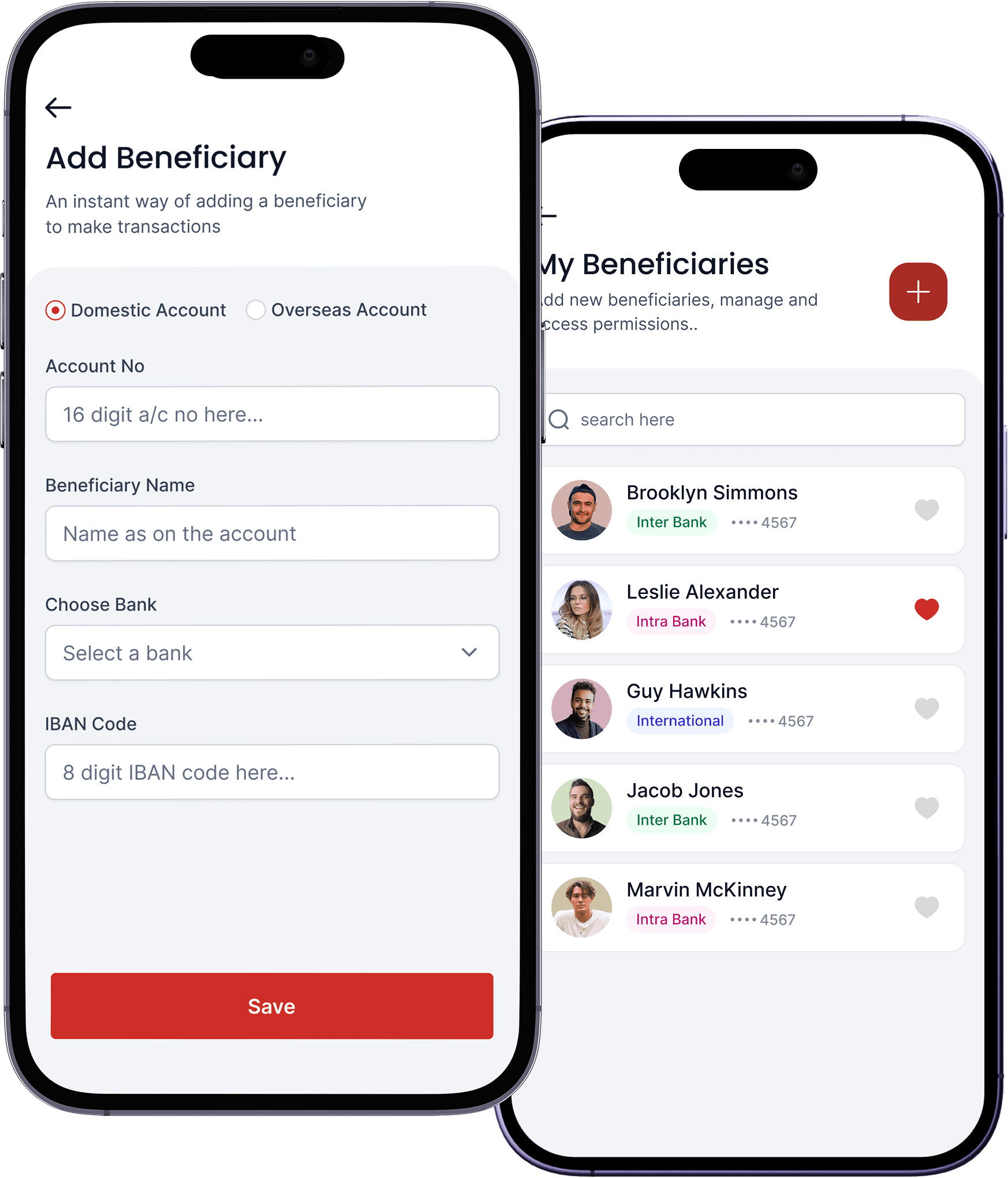

FEATURES

Product Redesign

Capabilities

- Application branding modernisation and experience improvisation

- User-friendly interfaces and consistent branding

Impact

- Increased user engagement by 30% and retention by 89%, enhancing trust and loyalty

- Improved conversion in major flows

Before

After

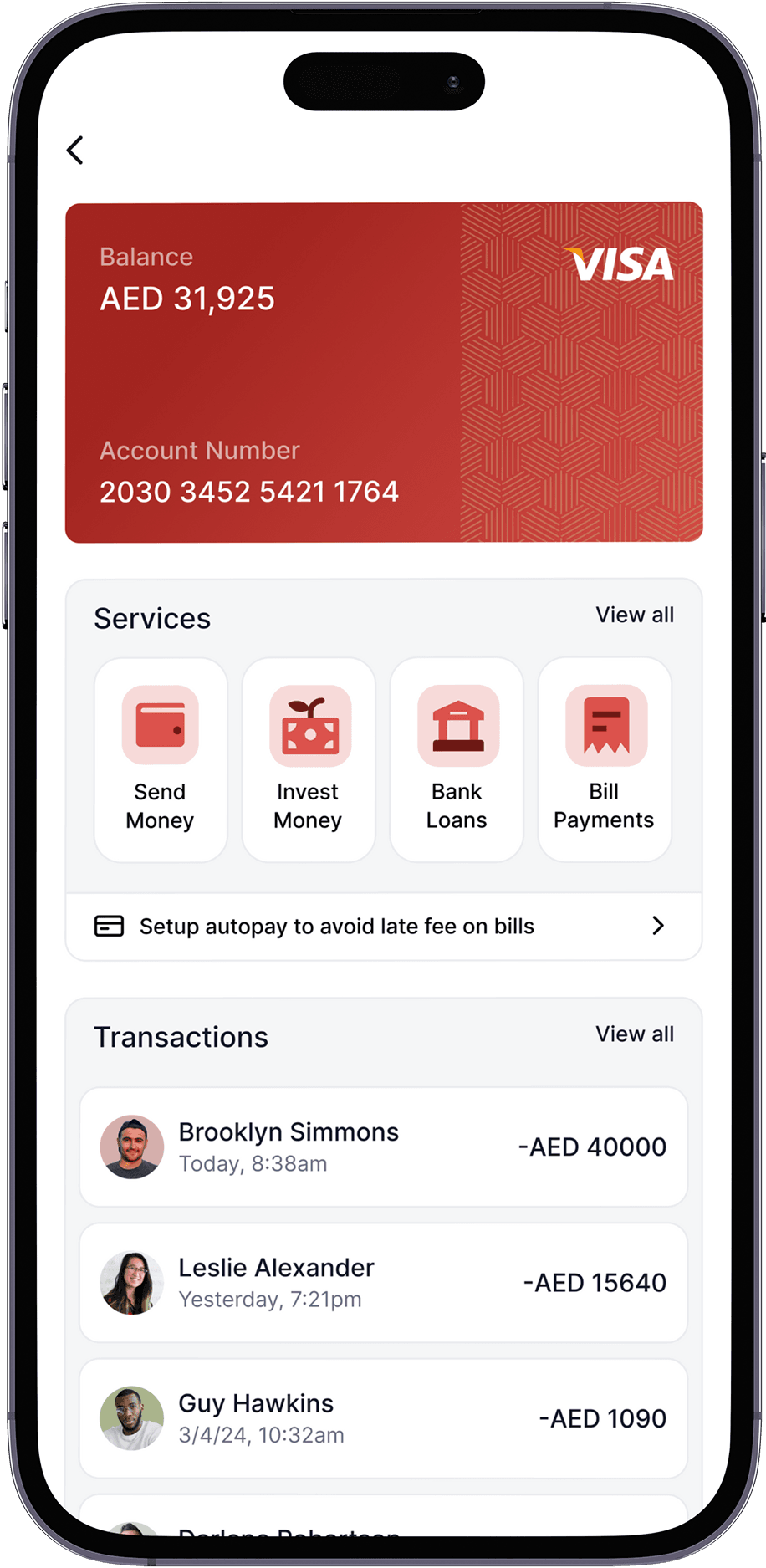

Fintech-Centric Digital Platform

- Seamless digital payments and fund transfers.

- AI-driven fraud detection and risk assessment.

- Automated compliance and regulatory tracking.

- Enhanced security with 92% fraud detection accuracy.

- Reduced transaction processing time by 50%.

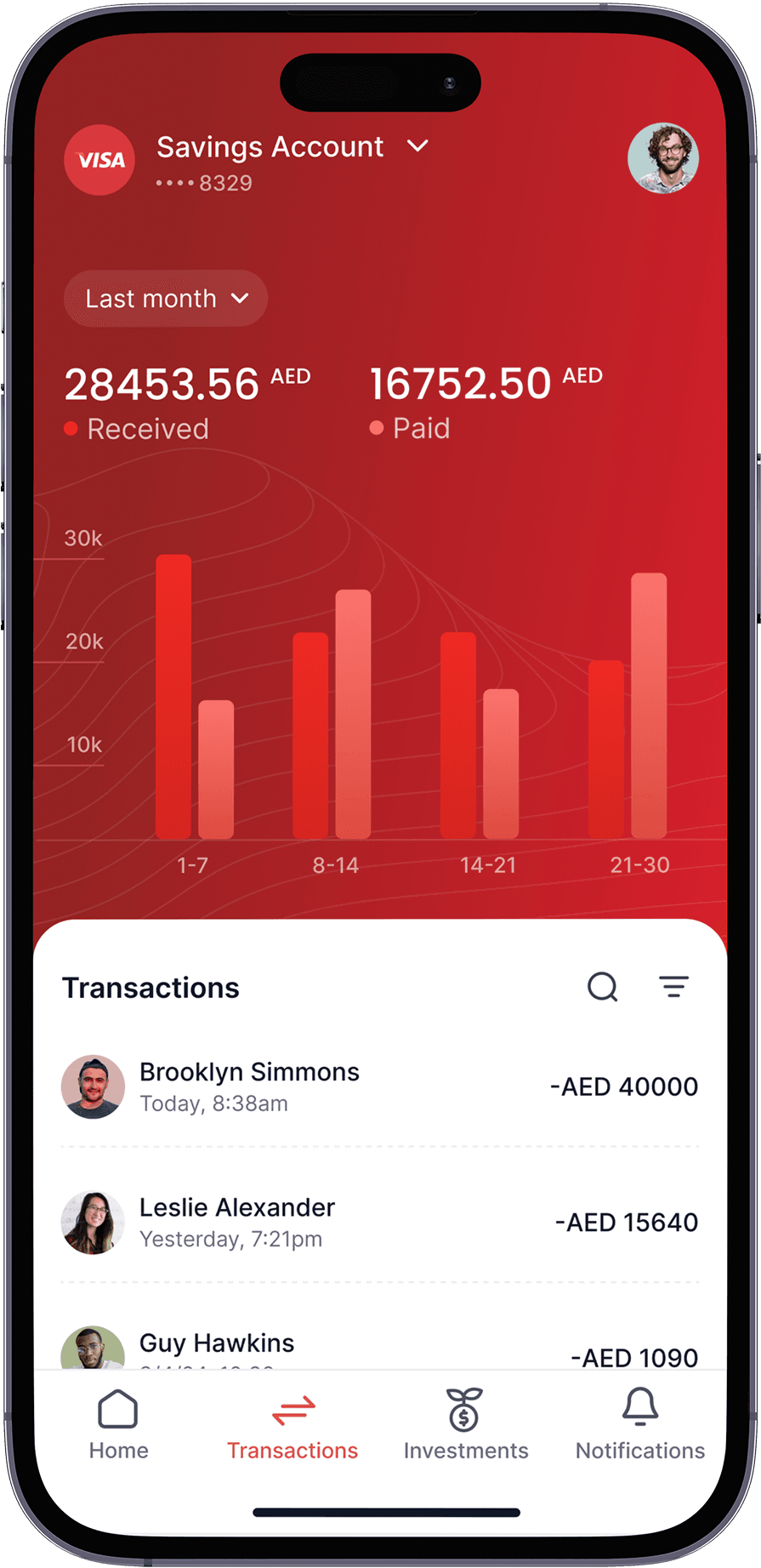

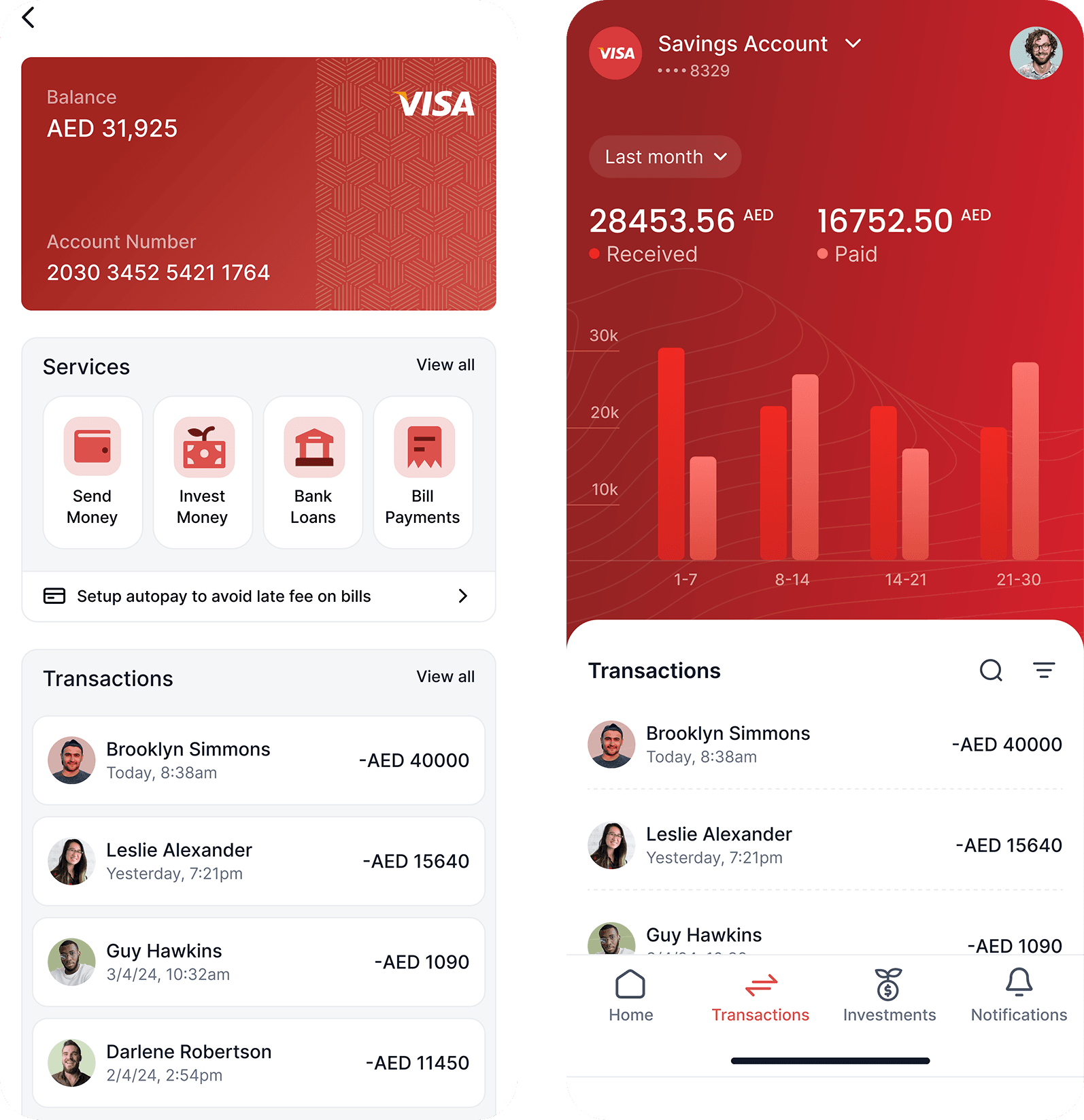

Smart Banking & Transactions

- Instant loan approvals with automated credit checks.

- Digital KYC and secure identity verification.

- AI-powered transaction insights for better money management.

- Increased loan disbursement efficiency, benefiting 3,000+ users.

- 40% faster account onboarding and approvals.

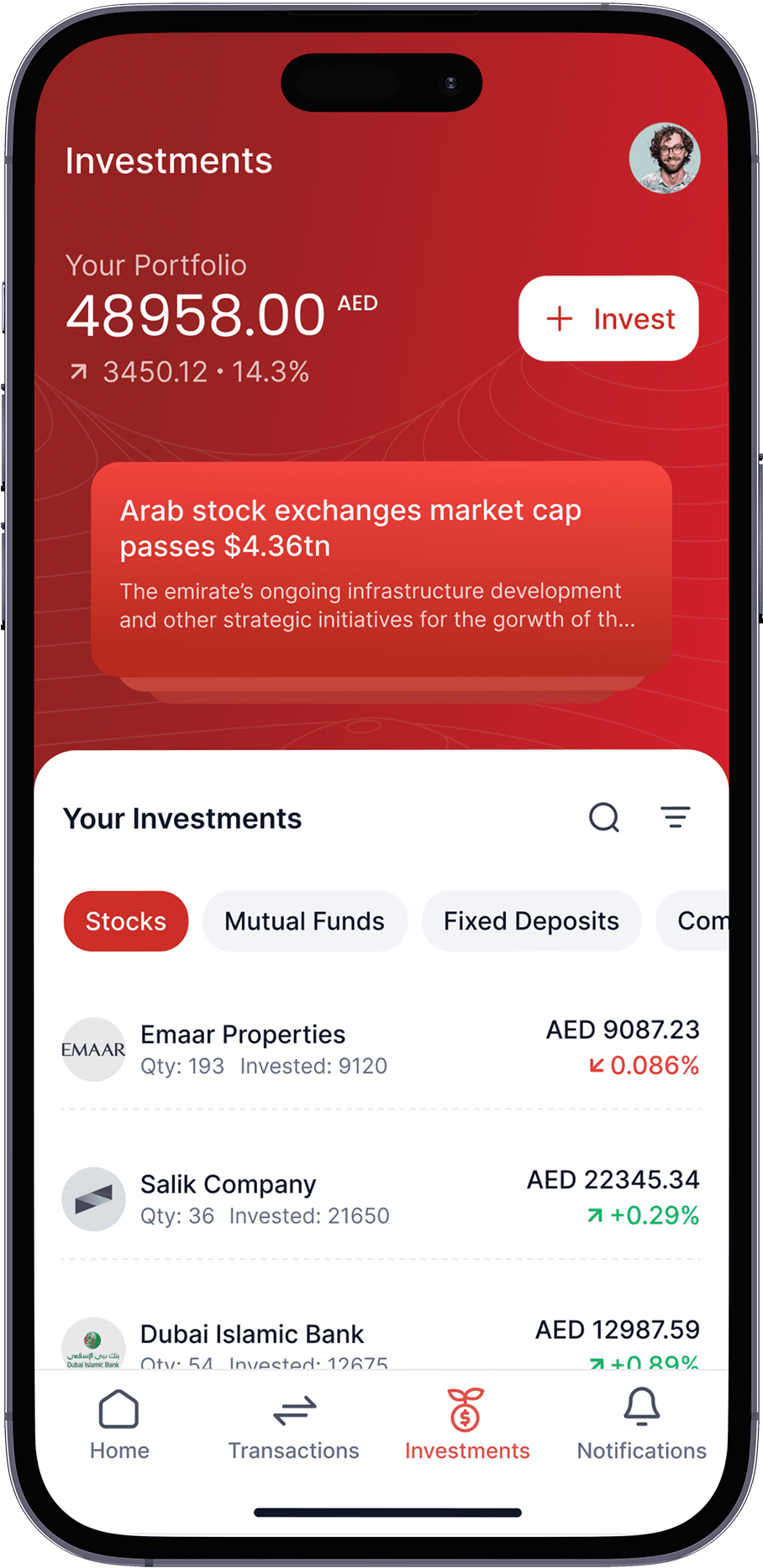

Financial Well-being & Wealth Growth

- AI-driven savings and investment recommendations.

- Real-time spending analysis with smart budgeting.

- Credit health monitoring and personalized financial advice.

- Increased savings adoption by 8% in the first year.

- Projected to improve financial literacy by 50% over the next decade.

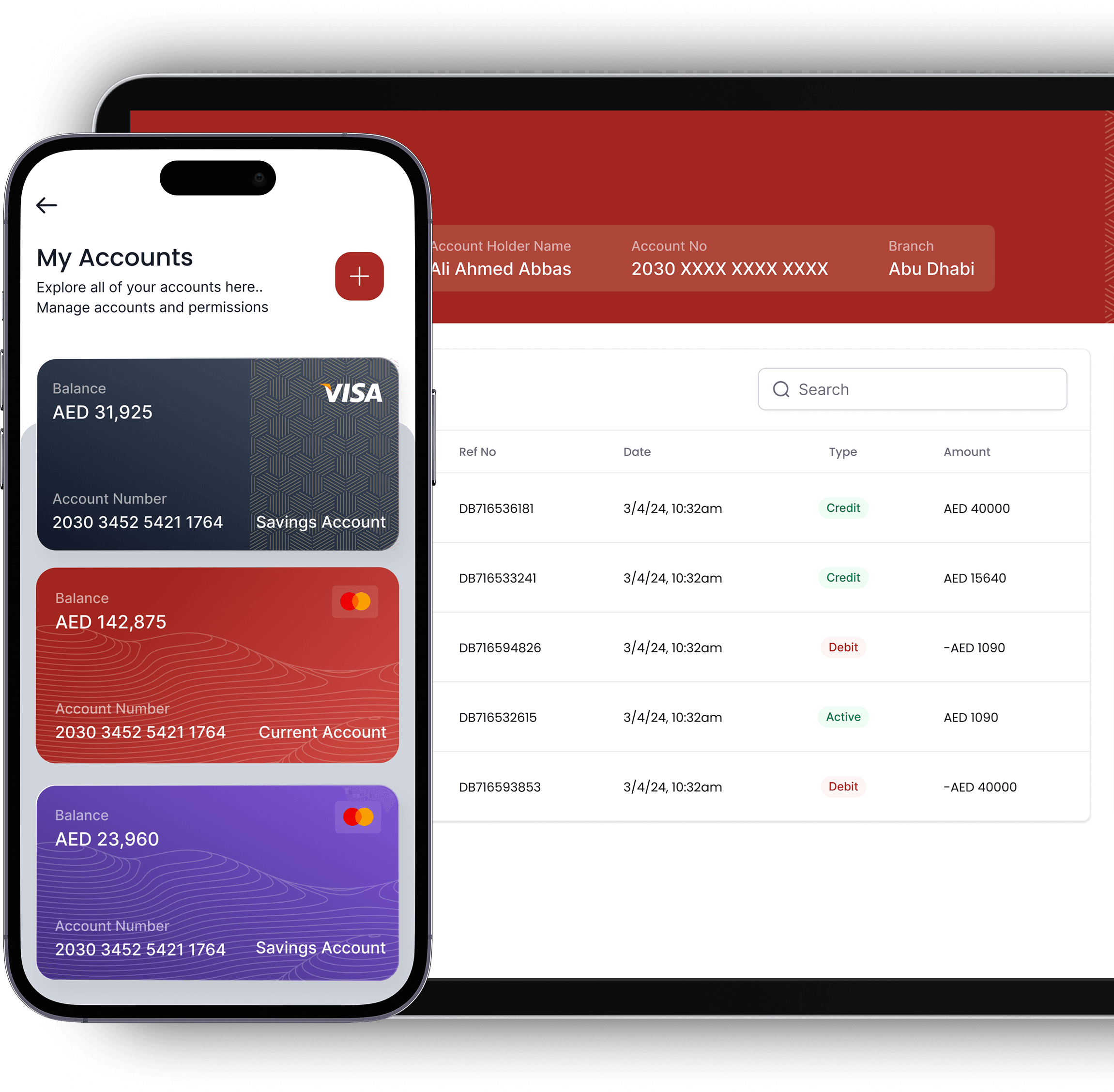

Unified Digital Finance Hub

- Integrated dashboard for managing bank accounts, loans, and investments.

- Multi-user access for seamless family financial management.

- Actionable insights to optimize financial planning.

- Improved financial tracking and wealth management.

- Faster decision-making with data-driven insights.

More case studies

Retail

Helping a leading retailer boost efficiency by 30% with AI-driven inventory optimization and automated operations.

Higher Customer Satisfaction

30%

Faster & More Reliable Deliveries

47%

Let’s work together

We are here to help you make your big idea a reality!