Client Overview

Our client, a leading retail provider, aimed to enhance shopping accessibility while streamlining inventory and order management.

Their vision was to build a seamless digital ecosystem that improves customer experience, optimizes retail operations, and drives business growth.

1.3 m

Users

0.5 m

Active Users

0.3 m

New Downloads

User Stories

Key BPMN

Tech Scope

What we did

Design

Design

Maze

Figma

Engineering

Engineering

Trymata

Adobe

Userbob

Miro

Maze

Figma

The Problem

1

Low Conversion Rates

Users leave purchases incomplete due to a lack of seamless checkout options.

2

Limited Personalization

Generic product recommendations fail to match user preferences, reducing engagement.

3

Inventory & Supply Chain Challenges

Retailers struggle with stockouts, overstocking, and inefficient logistics.

4

Fraud & Security Risks

E-commerce platforms face high return fraud and payment security threats.

Our Solution

1

Seamless Checkout & Payment Options

- One-click checkout and multiple payment methods reduce friction in transactions.

- Buy now, pay later (BNPL) and instant financing improve affordability for customers.

2

Smart Inventory & Logistics Management

- Real-time stock tracking prevents overstocking and stockouts.

- AI-driven demand forecasting optimizes supply chain efficiency.

Our Solution

One-Click Checkout

AI-Powered Personalization

Inventory Optimization

Seamless Omnichannel Experience

Loyalty & Rewards Programs

Fraud Prevention

Flexible Payment Options

Results

Higher Customer Satisfaction

30%

Users experienced better food quality with improved packaging and freshness tracking.

Faster & More Reliable Deliveries

47%

Optimized routes and real-time tracking improved delivery accuracy and reduced wait times.

Increased Order Conversions

3k+

A seamless checkout process made ordering easier, leading to fewer cart abandonments.

Stronger Security & Trust

40%

Secure payment methods and biometric authentication increased user confidence.

Over all, Increased user satisfaction with 92% positive feedback.

Results

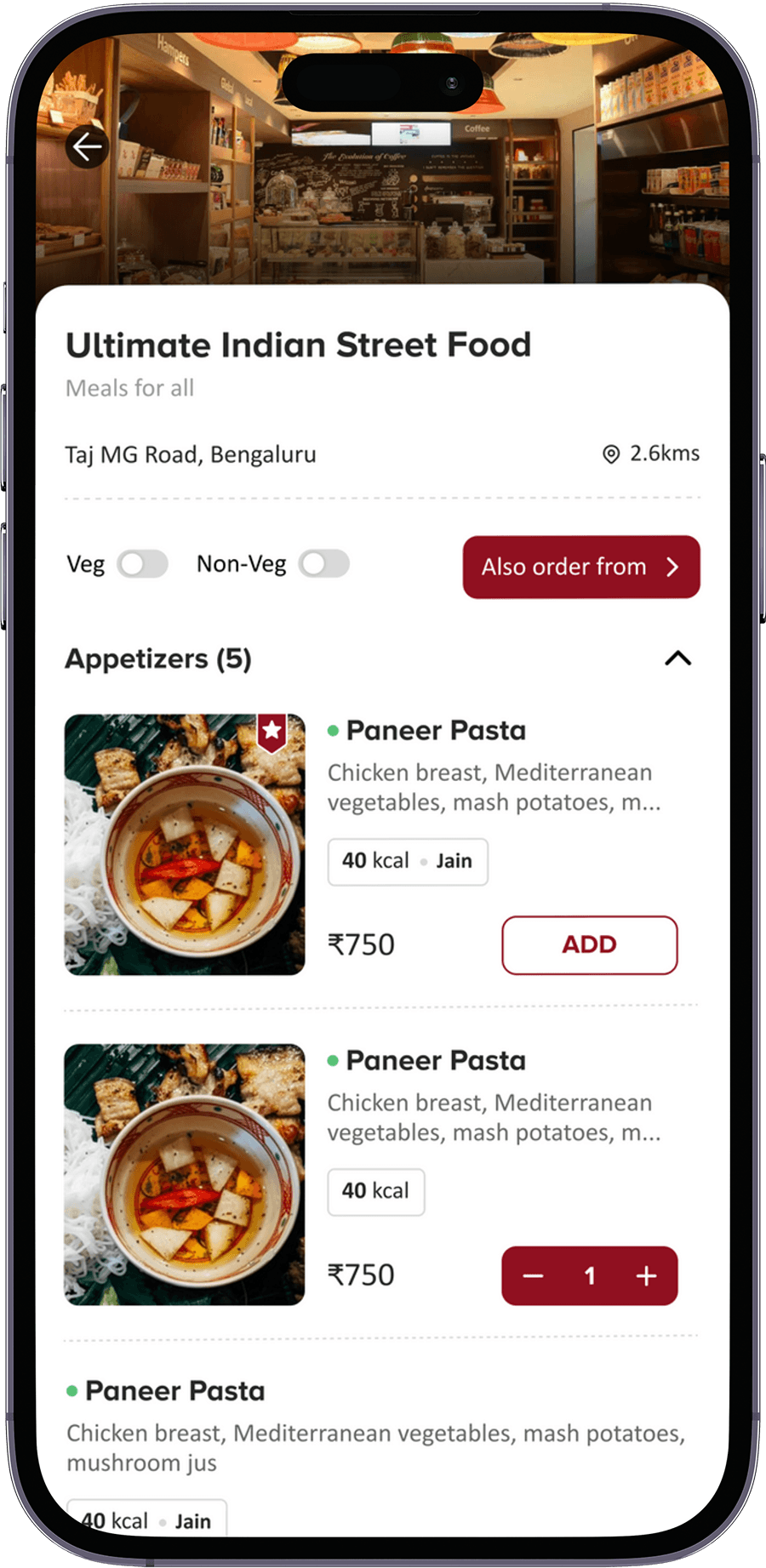

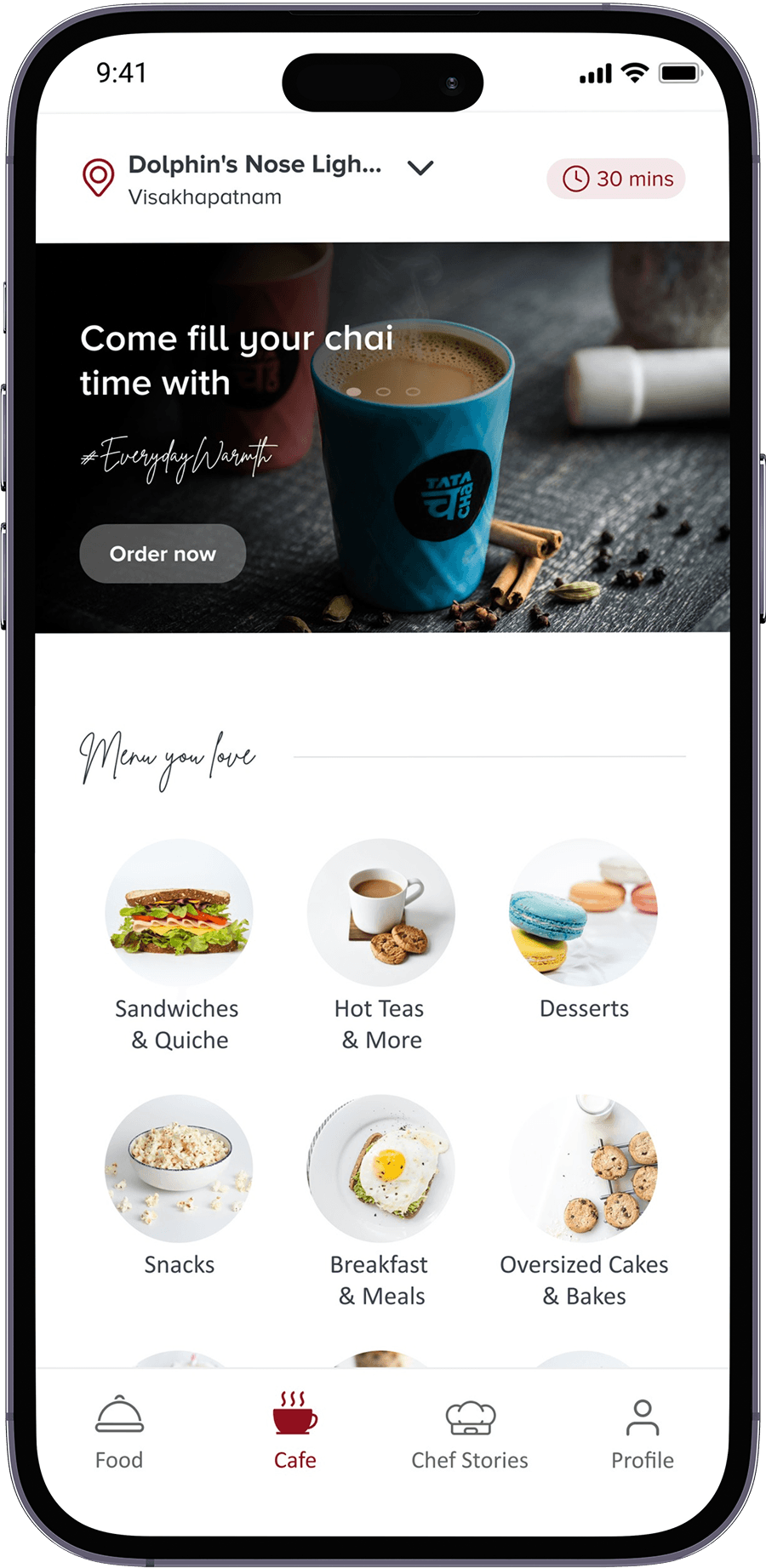

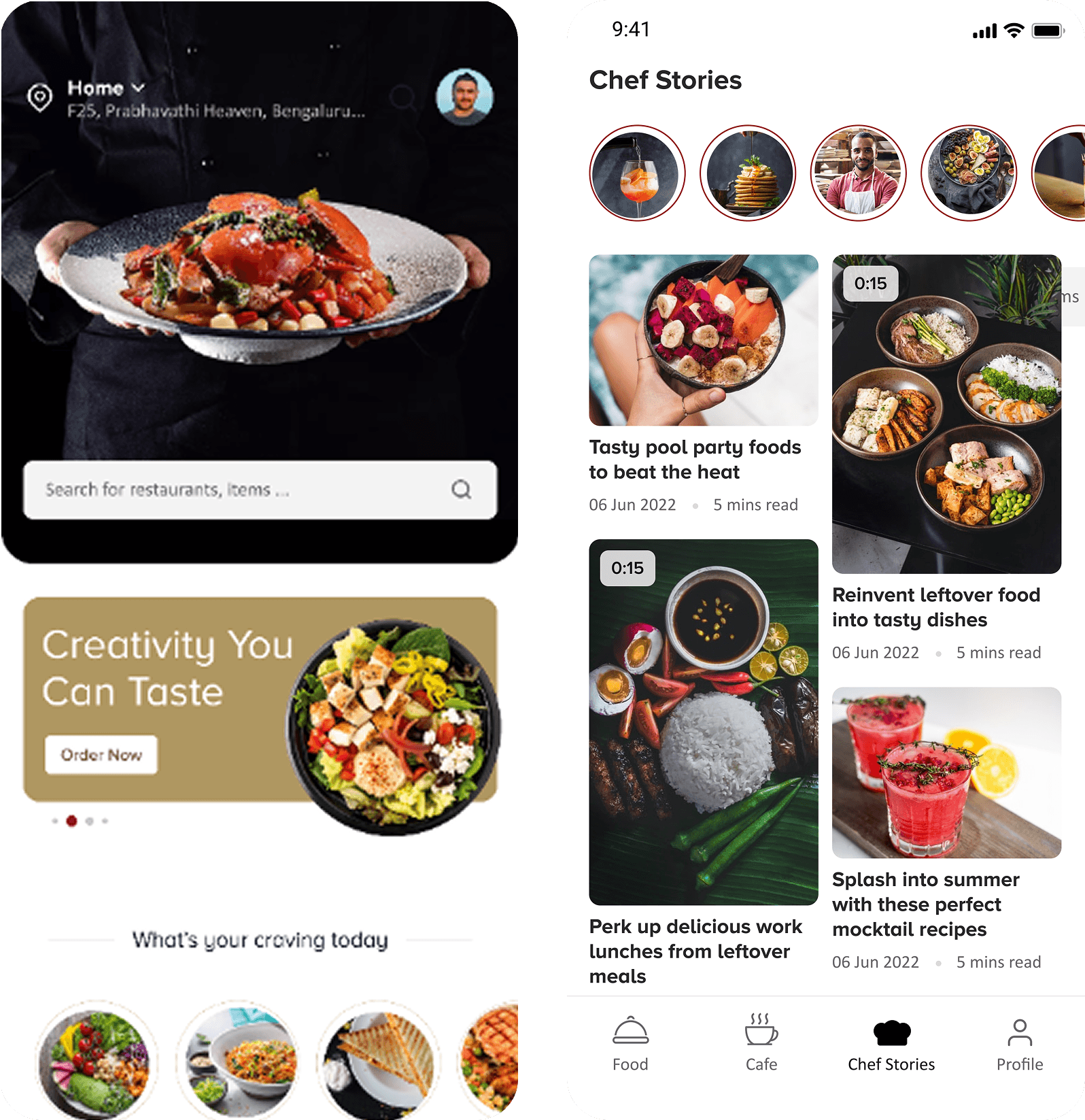

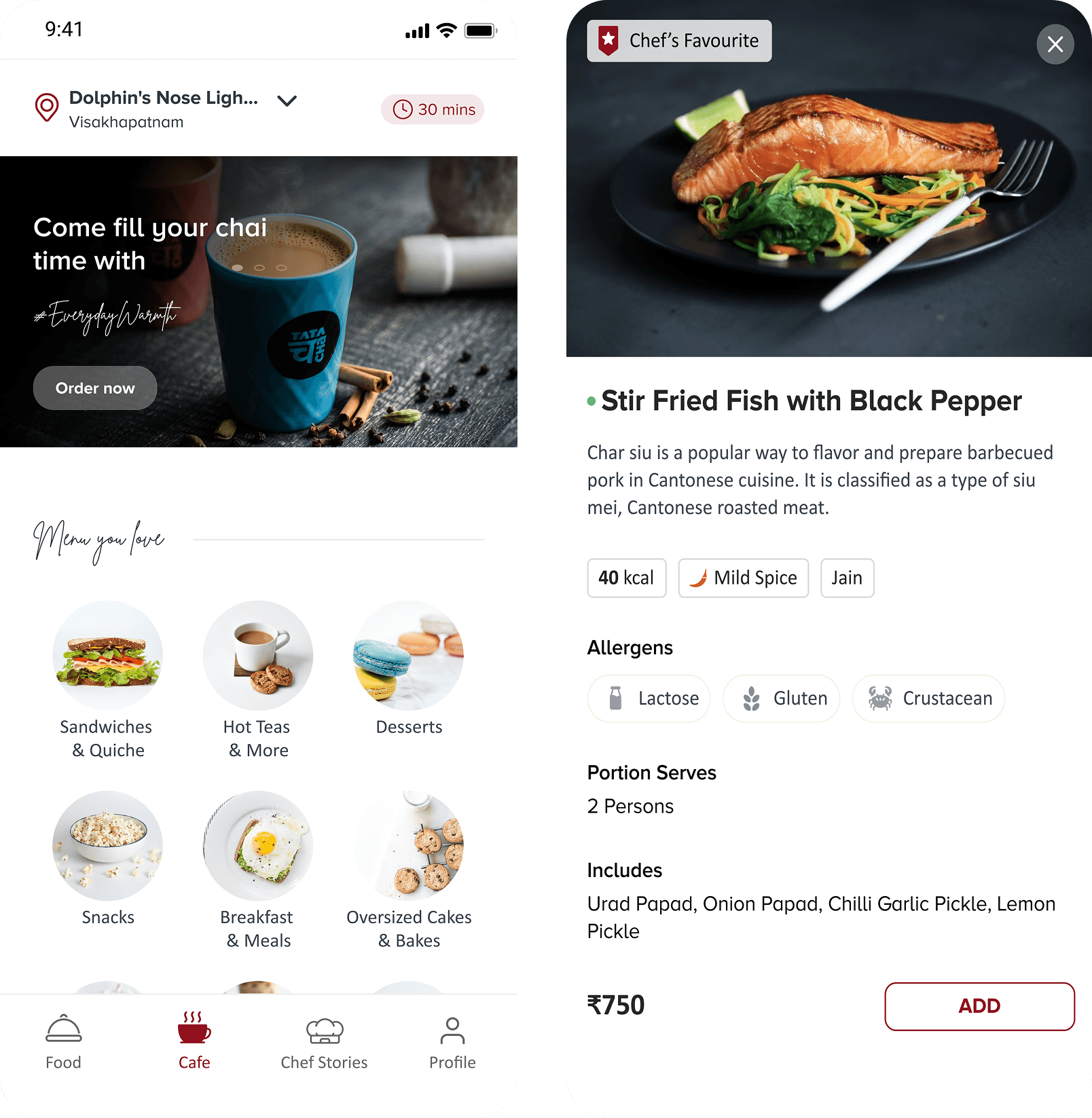

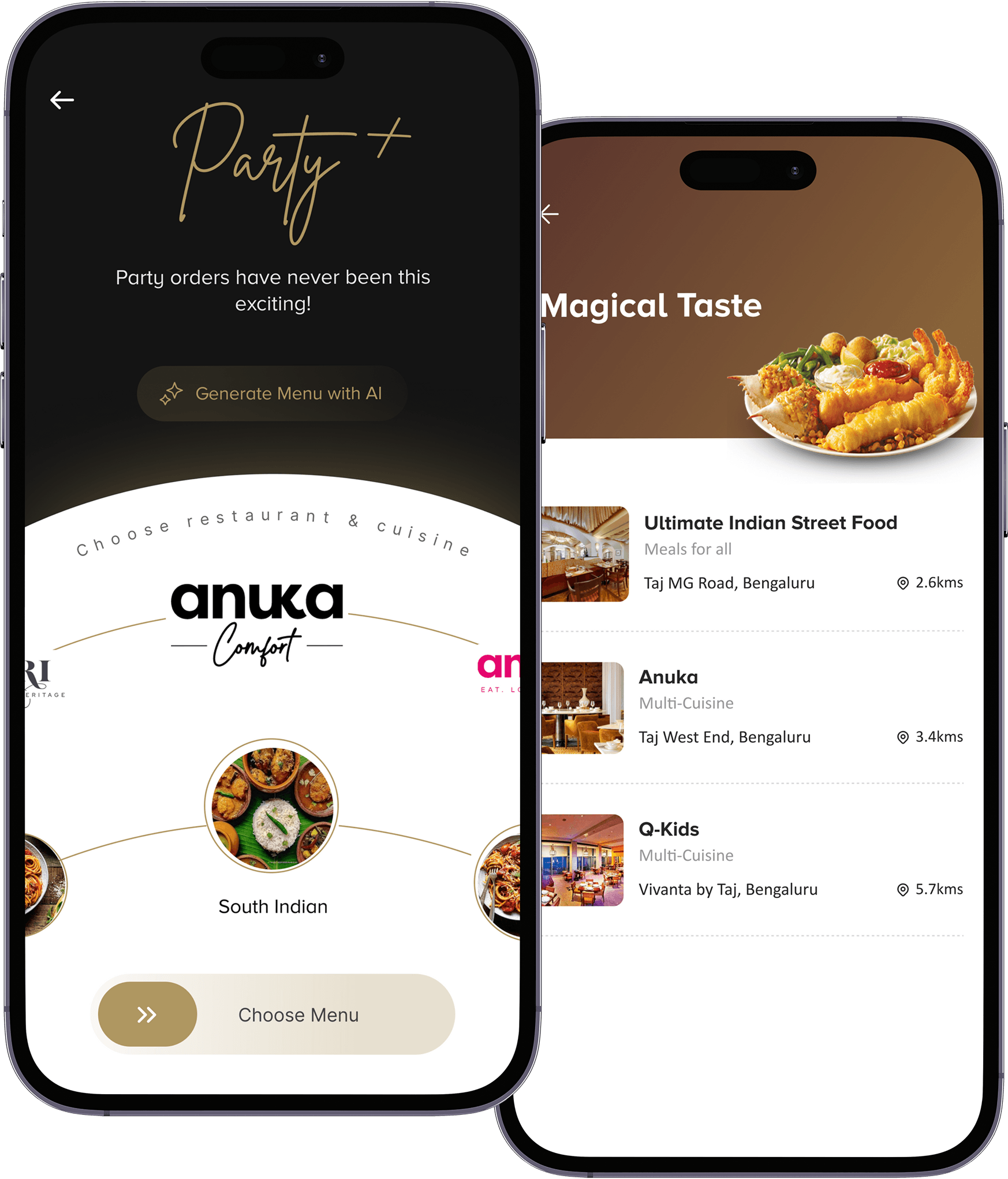

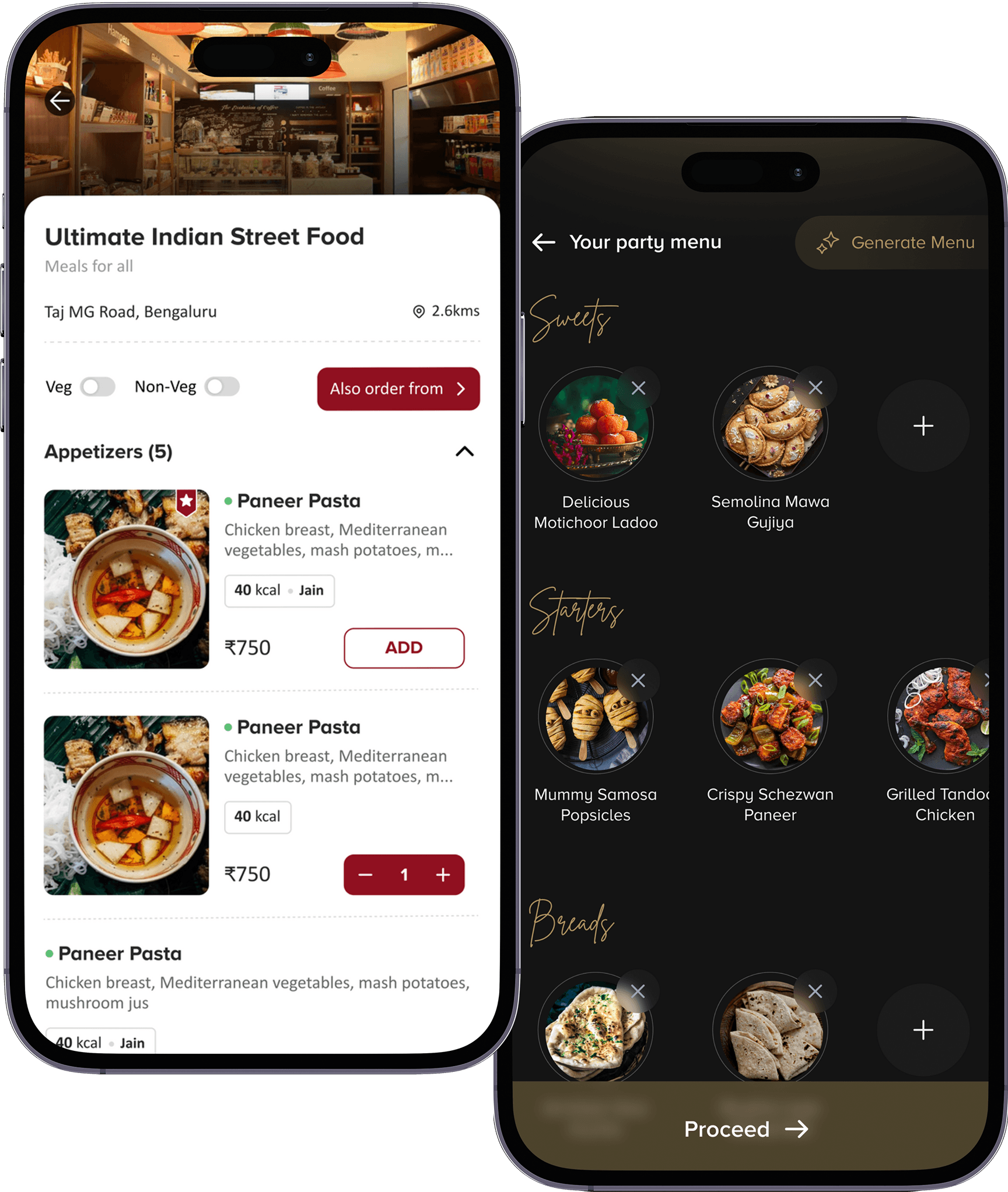

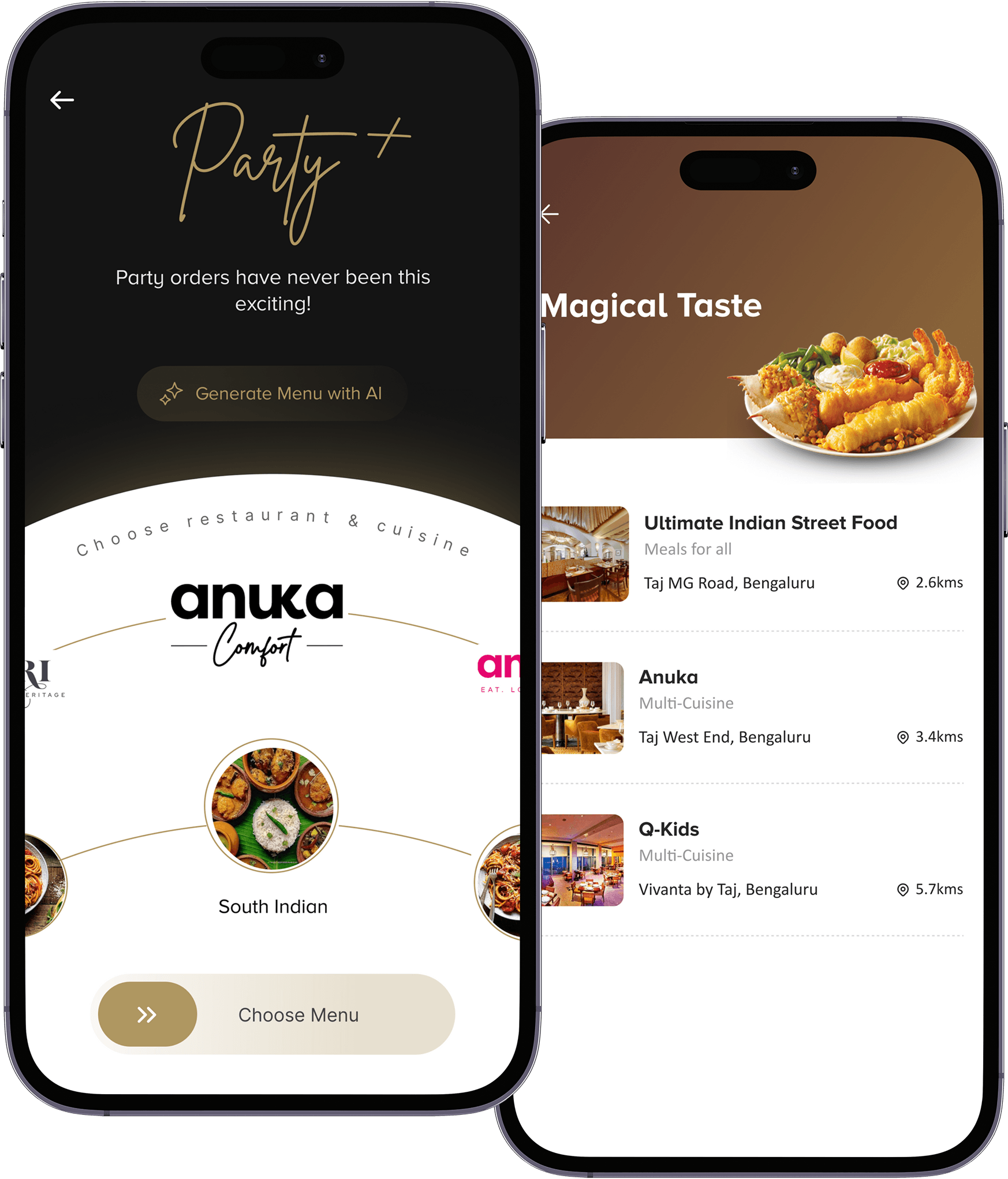

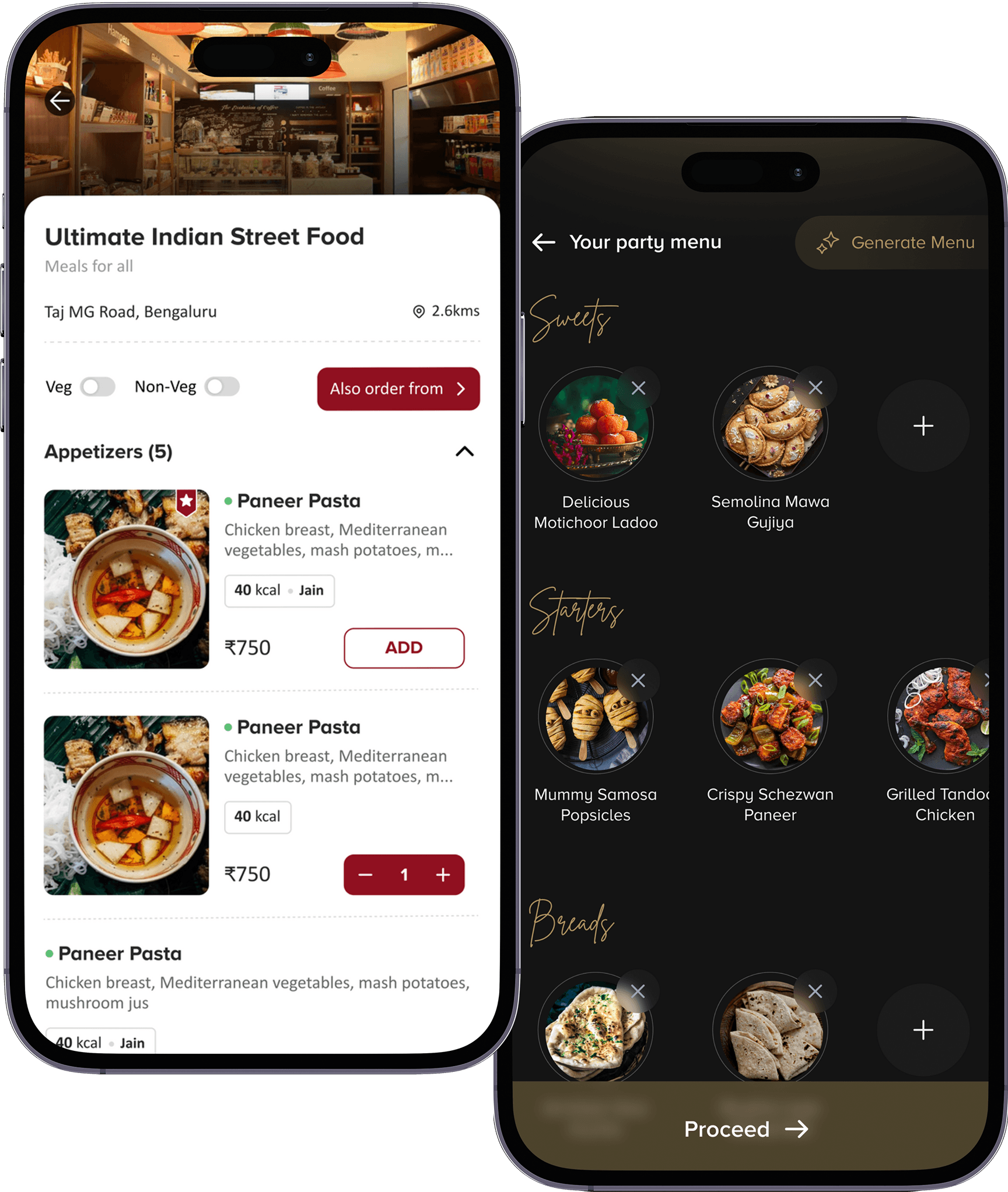

FEATURES

Product Redesign

Capabilities

- Application branding modernisation and experience improvisation

- User-friendly interfaces and consistent branding

Impact

- Increased user engagement by 30% and retention by 89%, enhancing trust and loyalty

- Improved conversion in major flows

Before

After

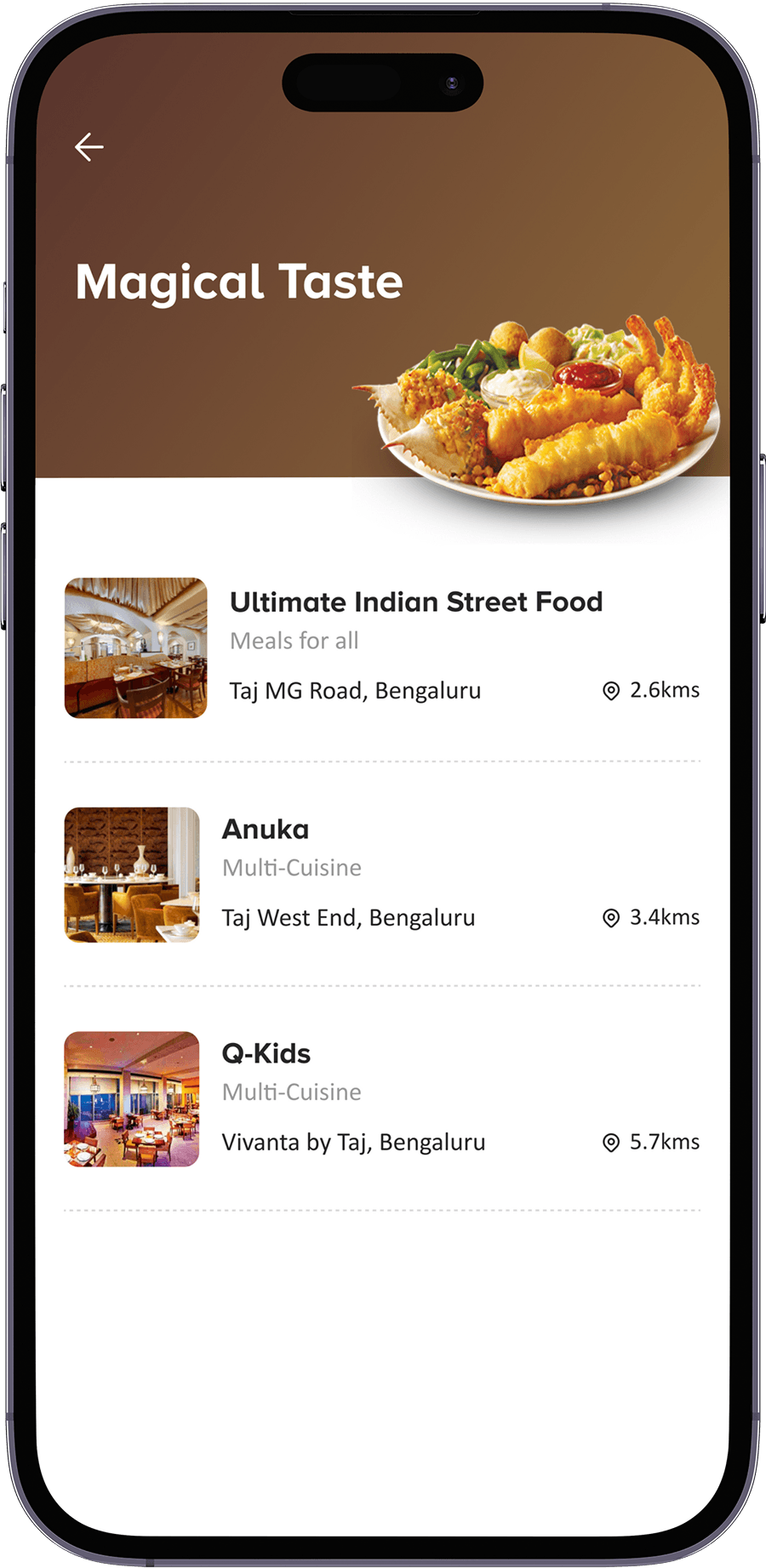

Retail-Centric Digital Transformation

- Seamless omnichannel shopping experience across mobile, web, and in-store.

- AI-powered product discovery and personalized recommendations.

- Real-time inventory synchronization and automated stock alerts.

- Improved customer engagement, leading to a 30% increase in repeat purchases.

- Reduced stock mismanagement, enhancing operational efficiency by 50%.

Optimized Retail Operations

- Smart order fulfillment with predictive demand analysis.

- Automated supply chain and vendor management system.

- AI-driven fraud detection and secure digital transactions.

- Onboarded 3,000+ retailers, streamlining order processing and logistics.

- Reduced manual intervention, increasing efficiency and cost savings.

Customer-Centric Growth Strategies

- Hyper-personalized promotions and AI-driven pricing strategies.

- Integrated loyalty programs with dynamic rewards and cashback options.

- Data-driven customer insights for better engagement and retention.

- Increased average customer spending by 8% within the first year.

- Strengthened customer loyalty, projecting a 50% retention boost over the next decade.

Next-Gen Retail Experience

- One-tap checkout with seamless digital payment options.

- AI-powered shopping assistants for guided buying decisions.

- Family shopping profiles with shared carts and real-time collaboration.

- Enhanced shopping convenience, reducing checkout time by 40%.

- Increased customer satisfaction through a frictionless retail journey.

More case studies

Edtech

Helping a leading EdTech platform enhance learning outcomes by 30% through AI-driven personalization and adaptive assessments.

Higher Student Engagement

30%

Increased Enrollment & Retention

47%

Let’s work together

We are here to help you make your big idea a reality!